Last week, was a very volatile full of central bank revelations. The US Fed indicated that there would be as many as three rate hikes next year. BoE surprised by raising the Bank Rate. Even ECB turned out to be less dovish as expected. But in the end, it was the late selloff in the stock markets that finalized that over tone.

There are still some worries over the fast spread of Omicron. Risk of return to stricter restrictions, lengthy supply bottlenecks and high inflation are there. Also, major central banks are clearly turning more hawkish on inflation. Hence, the stock markets were indeed rather resilient in this context.

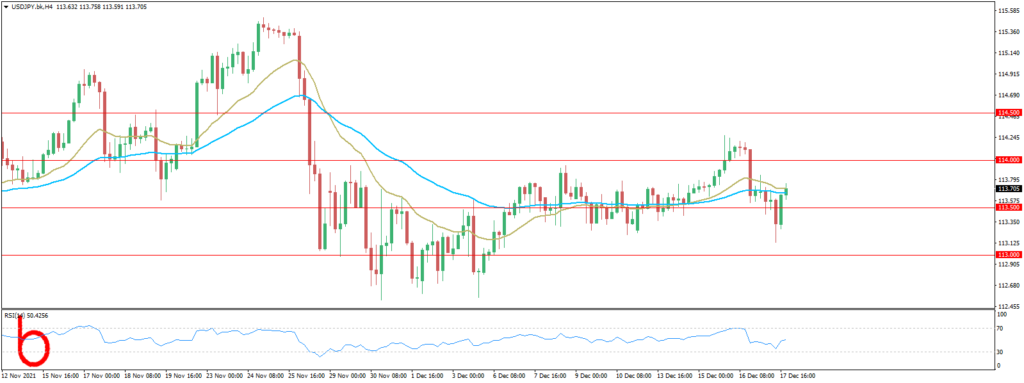

In the currency markets, the US Dollar ended as the strongest one, followed by the British pound and the Japanese Yen. The Canadian Dollar was the worst performer, followed by the Kiwi and then Euro.

Next week, it’s the pre-Christmas week and seven days after Christmas, it’s New Year’s Eve. In the lack of large players, the market these days will be quite thin, liquidity will be low, which can be fraught with all sorts of surprises. This is enhanced volatility, gaps with serious gaps in quotations, and what traders call the “Santa Claus Rally”. The most important scheduled updates this week will be

- the Australian Monetary Policy Meeting Minutes and Canadian Retail Sales on Tuesday

- the US quarterly Final GDP, Consumer Confidence and Existing Home Sales on Wednesday

- the Canadian monthly GDP, Core PCE Price Index and Durable Goods Orders on Thursday

- Christmas-eve Friday, EU and US Banks will be closed

Major Currencies Performance and Signals

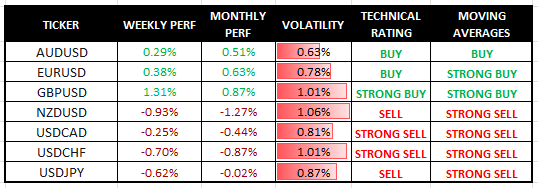

EUR/USD

The economic agenda of the year is practically exhausted, and no extra-important news is expected in the coming week. We expect the EURUSD pair to range this week as we going to experience low volatility due to the upcoming holidays.

FORECAST: NEUTRAL

Resistance: 1.1250, 1.1300, 1.1350

Support: 1.1200, 1.1150, 1.1100

GBP/USD

The British Pound has been weakening last week due to the US Dollar strength. The UK GDP data for the Q3, which will be released on Wednesday, December 22 and the markets will focus on the situation with the spread of the new Covid-19 wave.

FORECAST: NEUTRAL

Resistance: 1.3250, 1.3300, 1.3350

Support: 1.3200, 1.3150, 1.3100

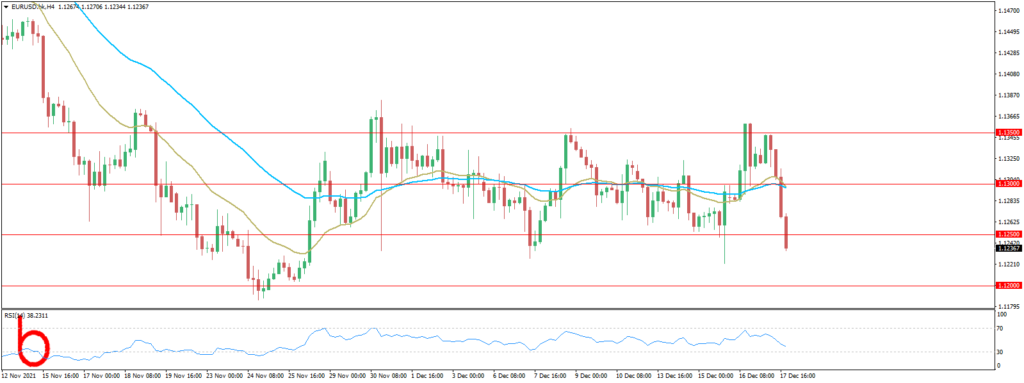

AUD/USD

The Aussie Dollar ended the week on a negative due to the US Dollar strength. We expect this week for the bearish momentum to continue but due to the holidays the volatility will be low.

FORECAST: SELL

Resistance: 0.7200, 0.7250, 0.7300

Support: 0.7100, 0.7050, 0.7000

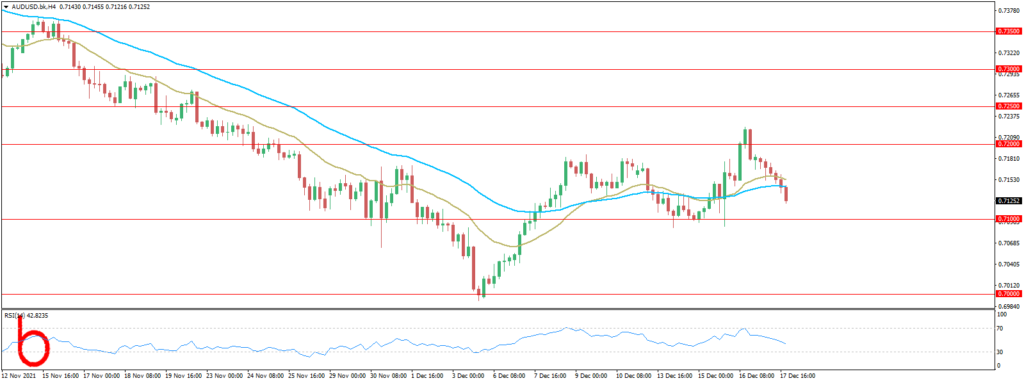

USD/JPY

Last week, USDJPY has increased a bit but still staying withing the range. It’s a quiet week on the economic data front, with stats limited to inflation figures for November. We don’t expect Yen sensitivity to the numbers, however.

FORECAST: NEUTRAL

Resistance: 114.00, 114.50, 115.00

Support: 113.50, 113.00, 112.50,

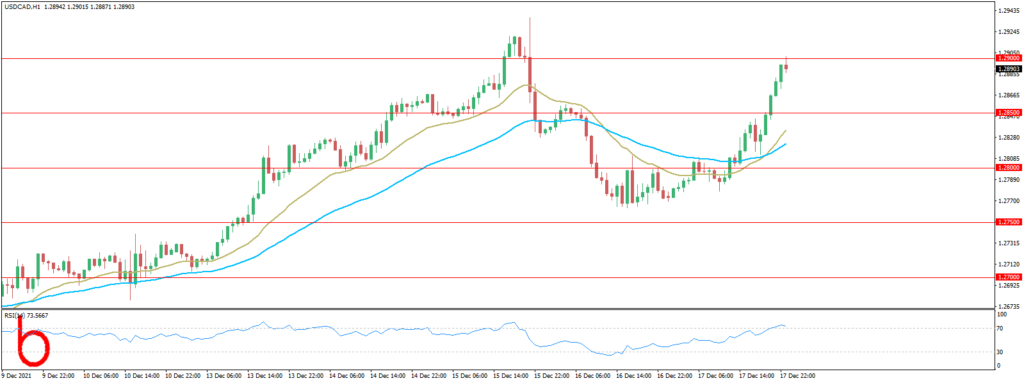

USD/CAD

The Loonie ended the week up bullish, last week, which closed in the top quarter of its price range, making the highest weekly closing price seen in more than one year. Although these are bullish signs, it is important to note that the price has been failing to break above 1.3000 all year,

FORECAST: BUY

Resistance: 1.2900, 1.2950, 1.3000

Support: 1.2850, 1.2800, 1.2750

Warning:

Trading on CFDs involves a high level of risk, including full loss of your trading funds. Before proceeding to trade, you must understand all risks involved and acknowledge your trading limits, bearing in mind the level of awareness in the financial markets, trading experience, economic capabilities and other aspects.

Disclaimer:

Market Trends, Charts, Trading Ideas or other information provided by BKFX (Pty) Ltd and/or third parties are not intended as an investment advice and/or recommendation. The information provided is not presented as suitable or based on your specific need. You are responsible for your own investment decisions and you should not trade with money you cannot afford to lose. Any views or opinions presented in this Article are solely those of the author and do not necessarily represent those of the Company, unless otherwise specifically stated. The Company may provide the general commentary which is not intended as an investment advice and must not be construed as such. Seek advice from a separate financial advisor if an investment advice is needed. The Company assumes no liability for errors, inaccuracies or omissions, inaccuracies or incompleteness of information, texts, graphics, links or other items contained within this article/material.