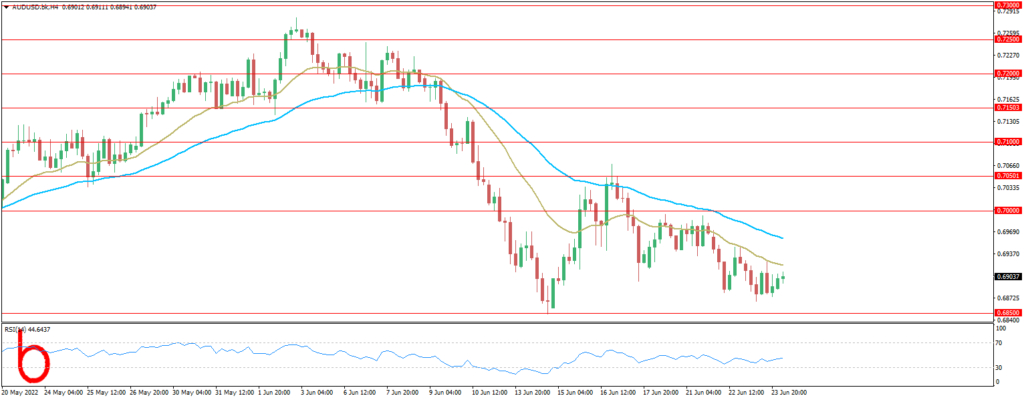

The AUD/USD pairwent down around 0.6900 as recession fears stand, for the time being, amid a quiet Asian session on Friday. Also keeping the Aussie buyers optimistic is the scheduled speech from Reserve Bank of Australia (RBA) Governor Philip Lowe, around 11:30 GMT.

Fears of economic slowdown triggered the market’s rush to risk safety the previous day, which in turn weighed on the AUD/USD prices due to its risk-barometer status. In doing so, the Aussie pair couldn’t cheer upbeat PMIs at home, nor the softer US activity numbers, as the US dollar benefited from the risk-aversion wave.

Elsewhere, the Fed Chairman Jerome Powell quoted inflation and recession woes as the challenges to ensure a smooth landing, despite expecting firmer growth this year, during his second round of Testimony. The central banker’s concern for recession joined downbeat US data to favor the risk-off mood.

Looking forward, RBA’s Lowe is likely to repeat his hawkish bias, especially after the recently upbeat Aussie PMIs, which in turn could favor the AUDUSD bulls. However, any mentioning of economic fears could join the latest downbeat performance of iron ore, Australia’s key export item, to recall the bears.

Warning:

Trading on CFDs involves a high level of risk, including full loss of your trading funds. Before proceeding to trade, you must understand all risks involved and acknowledge your trading limits, bearing in mind the level of awareness in the financial markets, trading experience, economic capabilities and other aspects.

Disclaimer:

Market Trends, Charts, Trading Ideas or other information provided by BKFX (Pty) Ltd and/or third parties are not intended as an investment advice and/or recommendation. The information provided is not presented as suitable or based on your specific need. You are responsible for your own investment decisions and you should not trade with money you cannot afford to lose. Any views or opinions presented in this Article are solely those of the author and do not necessarily represent those of the Company, unless otherwise specifically stated. The Company may provide the general commentary which is not intended as an investment advice and must not be construed as such. Seek advice from a separate financial advisor if an investment advice is needed. The Company assumes no liability for errors, inaccuracies or omissions, inaccuracies or incompleteness of information, texts, graphics, links or other items contained within this article/material.