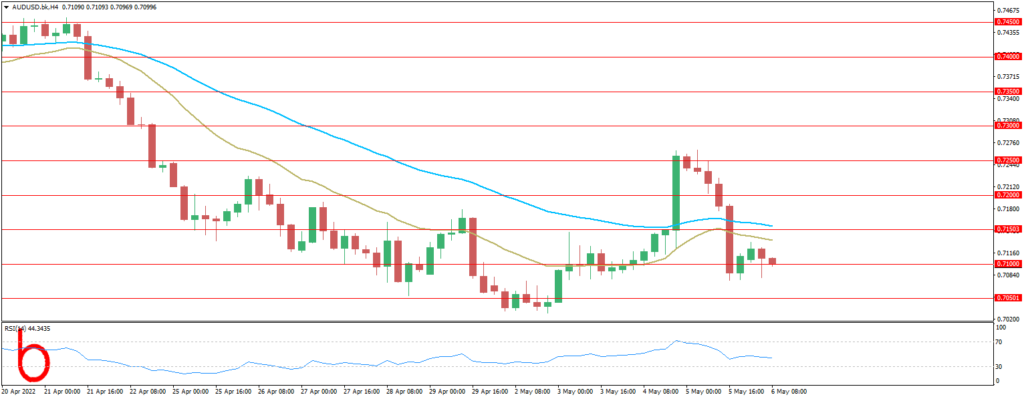

The Aussie is ranging around 0.7110, after losing nearly 150 pips the previous day, as traders expect the key catalysts while taking a breather following the heavily volatile sessions. That said, the Aussie pair’s latest inaction could also be linked to the cautious mode ahead of full markets as Japan finally returns to trading, following China’s trading restart on Thursday, after a long break.

The early Thursday’s optimism in the market couldn’t withstand the Bank of England’s (BOE) forecasts suggesting doubt-digit inflation and economic recession that rocked the boat in the US as well.

Following this, Wall Street indices slumped more than 3.0% each while the US 10-year Treasury yields rallied 3.40% on a daily closing while rising to the fresh high in late 2018 beyond 3.00%. As a result, the US Dollar Index (DXY) also regained its strength and poked April’s multi-month high around 104.00.

Looking forward, the Reserve Bank of Australia’s (RBA) justification of the larger-than-expected rate hike, via the Monetary Policy Statement (MPS), will be crucial for the AUD/USD traders, especially after the latest inflation and growth fears, which in turn could favor sellers if perceived negative. Also important will be the monthly employment report from the US as the Fed’s 50 bps rate hike hoped no major challenges from the jobs and inflation front.

Warning:

Trading on CFDs involves a high level of risk, including full loss of your trading funds. Before proceeding to trade, you must understand all risks involved and acknowledge your trading limits, bearing in mind the level of awareness in the financial markets, trading experience, economic capabilities and other aspects.

Disclaimer:

Market Trends, Charts, Trading Ideas or other information provided by BKFX (Pty) Ltd and/or third parties are not intended as an investment advice and/or recommendation. The information provided is not presented as suitable or based on your specific need. You are responsible for your own investment decisions and you should not trade with money you cannot afford to lose. Any views or opinions presented in this Article are solely those of the author and do not necessarily represent those of the Company, unless otherwise specifically stated. The Company may provide the general commentary which is not intended as an investment advice and must not be construed as such. Seek advice from a separate financial advisor if an investment advice is needed. The Company assumes no liability for errors, inaccuracies or omissions, inaccuracies or incompleteness of information, texts, graphics, links or other items contained within this article/material.