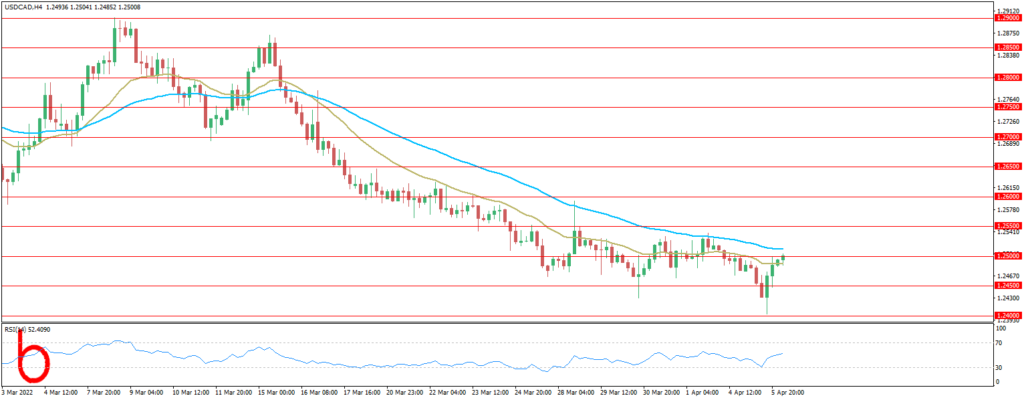

The USDCAD have been swinging in a volatile session on Tuesday, in a 90-pip range, with the US dollar of late, recovering some ground against the Loonie, but still bearish. At the time of writing, the USD/CAD bounced back to 1.2500

Volatility in European and US equities reflects a diverse market consensus with the hopes of a diplomatic exit to the Russian-Ukraine war decline. Europe’s response to Russian war crimes in Bucha, from Russian troops to civilians, intensified the conflict. Germany and France banished Russian diplomats while the EU explores a coal and oil embargo against Russia. However, there are still some discussions in the latter as the German Finance Minister Lindner said that a ban on Russian gas imports would be more harmful to Germany than Russia.

On Tuesday, Fed Governor Lael Brainard said that the US central bank “is prepared to take stronger action if inflation and inflation expectations suggest the need to do so.” She added that policy would be tightened “methodically” with a series of interest rates and would begin to lower the balance sheet as soon as the May meeting.

The Canadian economic calendar featured February’s Balance of Trade which printed a surplus of C$2.66 billion against C$2.4 billion estimated, but trailed January’s reading, revised up to C$3.12 billion. The US docket unveiled March’s US ISM-Non Manufacturing PMI, which rose to 58.3, higher than the 58.1 estimated and better than the 56.5 from the previous reading.

Warning:

Trading on CFDs involves a high level of risk, including full loss of your trading funds. Before proceeding to trade, you must understand all risks involved and acknowledge your trading limits, bearing in mind the level of awareness in the financial markets, trading experience, economic capabilities and other aspects.

Disclaimer:

Market Trends, Charts, Trading Ideas or other information provided by BKFX (Pty) Ltd and/or third parties are not intended as an investment advice and/or recommendation. The information provided is not presented as suitable or based on your specific need. You are responsible for your own investment decisions and you should not trade with money you cannot afford to lose. Any views or opinions presented in this Article are solely those of the author and do not necessarily represent those of the Company, unless otherwise specifically stated. The Company may provide the general commentary which is not intended as an investment advice and must not be construed as such. Seek advice from a separate financial advisor if an investment advice is needed. The Company assumes no liability for errors, inaccuracies or omissions, inaccuracies or incompleteness of information, texts, graphics, links or other items contained within this article/material.