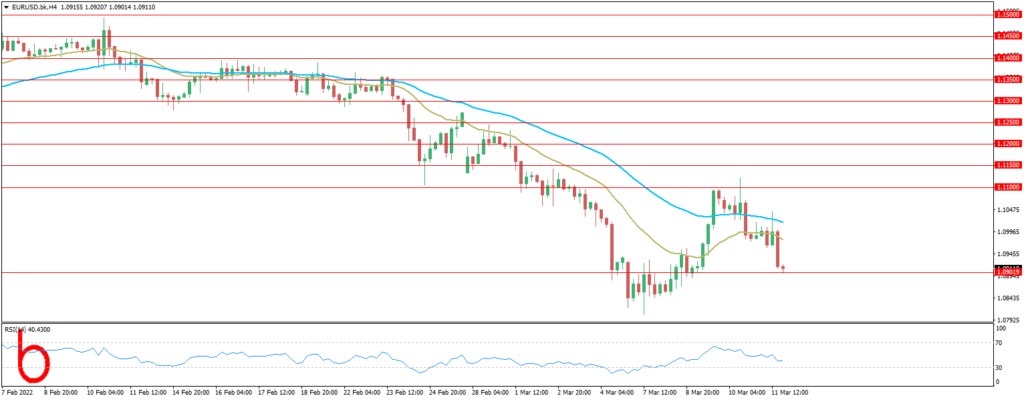

The Euro zone is under pressure from rising inflation due to commodity supply constraints (of which monetary policy cannot rectify) as well as its reliance on Russia/Ukraine. This has only exacerbated the divergence between the Fed and ECB respectively. Looking ahead to next week, the Fed’s interest rate decision dominates the calendar (see below) and is likely to incorporate a 25bps hike – almost fully priced in by money markets.

Strong labour and inflation data (40-year highs reached yesterday) should keep the 25bps outlook intact. Fed Chair Jerome Powell also stated last week that there is a possibility of one or two rate hikes greater than 25bps which shows the aggressive intent by the Fed to tackle inflation. Another bout of hawkish comments during the press conference could lead to additional downside on EUR/USD.

Warning:

Trading on CFDs involves a high level of risk, including full loss of your trading funds. Before proceeding to trade, you must understand all risks involved and acknowledge your trading limits, bearing in mind the level of awareness in the financial markets, trading experience, economic capabilities and other aspects.

Disclaimer:

Market Trends, Charts, Trading Ideas or other information provided by BKFX (Pty) Ltd and/or third parties are not intended as an investment advice and/or recommendation. The information provided is not presented as suitable or based on your specific need. You are responsible for your own investment decisions and you should not trade with money you cannot afford to lose. Any views or opinions presented in this Article are solely those of the author and do not necessarily represent those of the Company, unless otherwise specifically stated. The Company may provide the general commentary which is not intended as an investment advice and must not be construed as such. Seek advice from a separate financial advisor if an investment advice is needed. The Company assumes no liability for errors, inaccuracies or omissions, inaccuracies or incompleteness of information, texts, graphics, links or other items contained within this article/material.