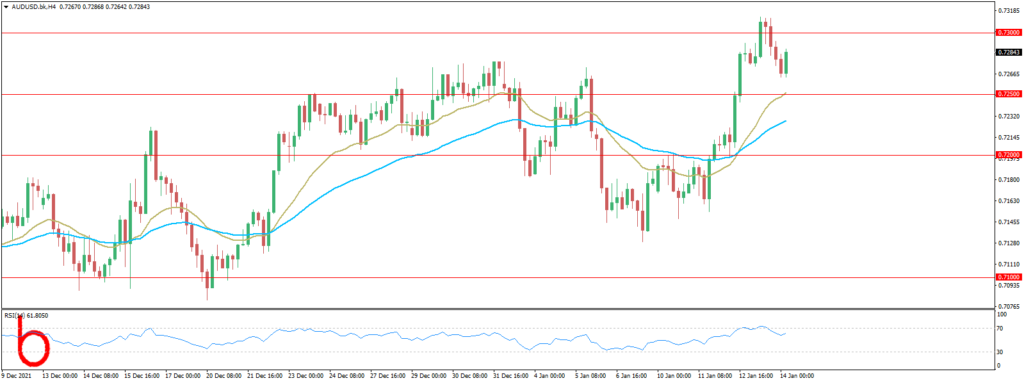

At the time of writing, the AUDUSD prices hover around at 0.7285. The market sentiment is pessimistic, as portrayed by global equities falling. In the FX market, risk-sensitive currencies.

The newest improvements in the US keep the Aussie traders resting on the dynamics of its economy. The US macroeconomic bill showed that Initial Jobless Claims for the week ending on January 7 rose 230K, higher than the 200K estimated by analysts, while prices paid for producers in December, also called PPI, decelerated, came at 9.7%, a tenth lower of the 9.8% foreseen.

The Federal Reserve would increase rates at least three times, presumably beginning in March. Fed speakers through the week, led by Chief Powell, and Vice-Chair nominee Lael Brainard, said that a rate hike is possible in March and would like to reduce the balance sheet the sooner, the better. The Fed speakers who expressed those views were: Regional Fed’s Presidents Bostic, Daly, Mester, and Barkin.

Fed aside, the Reserve Bank of Australia keeps its dovish stance in place. Furthermore, as noted in the RBA’s last monetary policy minutes, the Australian central bank said it would maintain highly supportive monetary policy conditions, and the board would be patient. The RBA noted that inflation increased but remained low, compared with other economies, like the US and the UK.

Warning:

Trading on CFDs involves a high level of risk, including full loss of your trading funds. Before proceeding to trade, you must understand all risks involved and acknowledge your trading limits, bearing in mind the level of awareness in the financial markets, trading experience, economic capabilities and other aspects.

Disclaimer:

Market Trends, Charts, Trading Ideas or other information provided by BKFX (Pty) Ltd and/or third parties are not intended as an investment advice and/or recommendation. The information provided is not presented as suitable or based on your specific need. You are responsible for your own investment decisions and you should not trade with money you cannot afford to lose. Any views or opinions presented in this Article are solely those of the author and do not necessarily represent those of the Company, unless otherwise specifically stated. The Company may provide the general commentary which is not intended as an investment advice and must not be construed as such. Seek advice from a separate financial advisor if an investment advice is needed. The Company assumes no liability for errors, inaccuracies or omissions, inaccuracies or incompleteness of information, texts, graphics, links or other items contained within this article/material.